EQUITY TRADING

3M

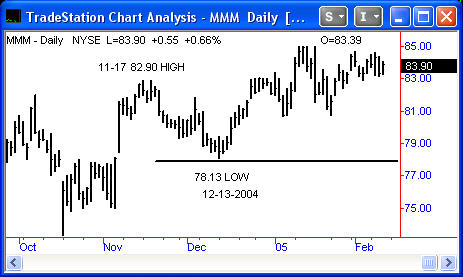

In the chart below of MMM I used the Start Price high of November 17 at 82.90. There are many indications around the same price level that point to the low price in the downward wave movement.

There is a SP-YCH algorithm at 78. The Start Time algorithm points to 78.3. Another algorithm, the MOD3, indicates 78.50. The ON DATE algorithm selects 78.0.

This is a perfect set-up since the indications were 78.0,78.3, 78.5, and 78.0. The low was 78.13. In this example the indicators work nicely for a reversal at the designated support point range of 78 to 78.5.

If one were long MMM from the 78 area, one is assuming a reversal upward. How much is unknown. What if November 17 was the start of a downtrend? We just don't know. As price begins to rise, what we can target however, is a resistance point of 83.

The trend does move upward and price stops at 83 for five days before going to 83.40 and then dropping to 80.73. The target of 83 is provided by DIFFERENT algorithms then what was used on the decline from 82.90 to 78. This works much the same way as Gann's 1908 US Steel trade went from a 42 low to a high of 58 3/4 and back to 42. The same numbers are involved, but different algorithms are used.

There is a perfect SP Class 1 to 83 in conjunction with a SP-YCH indicating 83. A Start Time algorithm can be built into a MOD3 and then a PT4V. It points to 83. This was a good target price that was broken after 7 days by .40 cents. The .40 slide past support is within reasonable stop tolerance.

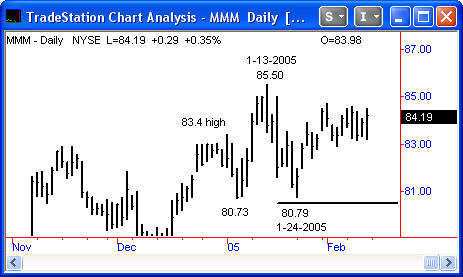

Following MMM further shows one how price won't always stop at, nor hit, the price targets. In this next example, price does not quite get into the buy range. In the chart of MMM above, I used the high at 85 1/2 on January 13, 2005 as a Start Price and Start Time respectively. There were four projections that pointed to a buy range of 80.1,80.5,80, and 80.5.

The lowest price went was 80.79 so a possible trade is missed by waiting for price to enter the buy zone.

Copyright ©2001 The StockTimefactor - All Rights Reserved